Blackstone Inc. (BX) trades at $125.25, yet a discounted cash flow (DCF) valuation estimates its worth at $52.22, suggesting significant overvaluation. For instance, high market expectations, opaque private market deals, and optimism about Middle East stability widen this gap. With private equity (PE) stocks commanding high multiples, is BX inflated by a bubble, or does the market see unique value in its Middle East prospects? This analysis explores BX’s valuation, risks, and strategic bets.

DCF Valuation: A Closer Look

A DCF model provides insight into BX’s intrinsic value. Specifically, it uses 2024 free cash flow to equity (FCFE) of $2,961,596,000, a 12% 5-year CAGR (near the 14% historical revenue CAGR), a 10% CAPM, a 3% perpetual growth rate, and 1,211,662,336 shares. The calculation yields:

Stock Price: $63,282,843,473 / 1,211,662,336 = $52.22

At $52.22, BX appears overvalued compared to its $125.25 market price and Barclays’ $186 target. Consequently, this suggests the market anticipates a CAGR exceeding 12% or a CAPM below 10%—both aggressive assumptions. Therefore, investors should question whether these expectations are sustainable.

Risks of Overvaluation

BX’s P/E ratio of 54.9 far exceeds the S&P 500’s ~25, driven by optimism despite challenges. For example, Q1 2025’s $385 million realization shortfall (46% below the $716 million consensus) highlights underperformance. Additionally, private market opacity conceals portfolio risks, complicating accurate assessments. Moreover, higher interest rates, with the 10-year Treasury at 4.57% in 2024, may compress deal returns. As a result, if expectations falter, BX’s stock price could face significant pressure, reflecting inflated valuations.

Middle East Strategy: Opportunity or Risk?

BX is betting heavily on Middle East stability to fuel growth. Specifically, it raised $7.5 billion in 2024 with Gulf sovereign wealth funds and secured a $1 billion Saudi PIF infrastructure deal in 2022. Furthermore, opportunities in UAE real estate and tech are promising. However, geopolitical risks, such as tensions with Iran, could disrupt these plans. Consequently, the market may be overpricing the success of BX’s Middle East strategy, adding to valuation concerns.

PE Bubble or Middle East Hype?

Private equity firms like BX and KKR trade at elevated multiples, despite a 15% drop in global deal value in 2024, according to PitchBook. For instance, BX’s valuation assumes robust growth, potentially signaling a bubble. Alternatively, excessive faith in Middle East stability may be fueling deal pipelines, inflating prices. In contrast, the $52.22 DCF valuation, far below $125.25, urges caution. Thus, market prices may reflect speculation rather than fundamentals, posing risks for investors.

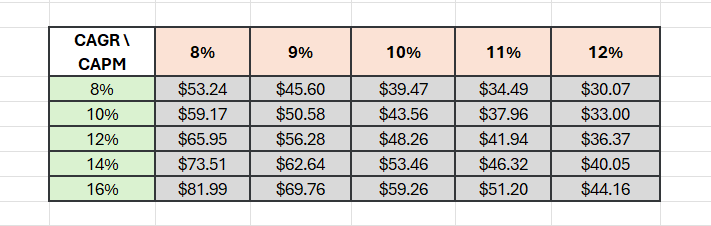

Sensitivity Analysis: Exploring Valuation Scenarios

A sensitivity analysis grid offers further clarity. Specifically, it uses 2024 FCFE ($2,961,596,000), 1,211,662,336 shares, and a 3% perpetual growth rate, varying CAPM from 8% to 12% and CAGR from 8% to 16%. This grid highlights how changes in growth and discount rates impact BX’s valuation. For example, lower CAPM or higher CAGR could justify a higher stock price. However, the current $52.22 valuation underscores the gap between market optimism and conservative estimates.

Navigating BX’s Valuation Risks

Ultimately, BX’s $125.25 stock price reflects high market expectations, driven by Middle East prospects and private equity enthusiasm. Yet, the $52.22 DCF valuation signals overvaluation, with risks tied to opaque deals, geopolitical uncertainties, and elevated interest rates. Moreover, the PE sector’s high multiples suggest a potential bubble. Therefore, investors should approach BX cautiously, weighing its Middle East strategy against fundamental risks to determine if the market’s optimism is justified.