Chevron Corporation (NYSE: CVX) stands as a global energy leader, adeptly navigating geopolitical complexities and financial markets. This analysis explores Chevron’s financial metrics, including the Capital Asset Pricing Model (CAPM) and Weighted Average Cost of Capital (WACC), their disparity, and implications for intrinsic value compared to the current stock price of $136.26 (as of May 2, 2025). Additionally, it examines Chevron’s deep-rooted Middle East operations, the potential impact of regional stability, associated risks, upside opportunities, and concludes with an expanded sensitivity analysis to assess valuation under varied scenarios.

Financial Metrics: CAPM and WACC Insights

Understanding CAPM

The Capital Asset Pricing Model (CAPM) estimates Chevron’s cost of equity, reflecting shareholder expectations for market risk. For instance, with a risk-free rate of 4.58%, a beta of 0.91, and a market return of 10%, Chevron’s cost of equity is approximately 9.51%. This metric highlights the premium investors seek for holding energy sector stocks.

Exploring WACC

Meanwhile, the Weighted Average Cost of Capital (WACC) blends Chevron’s equity and debt financing costs. Based on 2024 data, including $260.3 billion in equity and $24.541 billion in debt, WACC is around 8.84%. This lower rate stems from tax-advantaged debt, reducing overall financing costs.

Why the Disparity Matters

The 0.67% gap between CAPM (9.51%) and WACC (8.84%) arises because debt is cheaper, offering tax benefits and lower risk for debtholders. For example, Chevron’s moderate leverage keeps this difference small. CAPM drives FCFE valuations, aligning with equity risk, while WACC suits FCFF, valuing the entire firm. However, using WACC for FCFE underestimates equity value, emphasizing proper discount rate selection. A lower WACC enhances project funding, but CAPM guides shareholder-focused decisions.

Intrinsic Value vs. Stock Price

Chevron’s Intrinsic Value

Using an FCFE model with multi-stage growth, Chevron’s intrinsic value is estimated at $144.38 per share. This assumes a 2024 FCFE of $21.3 billion, 5% growth for five years, a 3% terminal growth rate, and 1,785 million shares. Consequently, the stock appears undervalued by 5.6% at $136.26, suggesting a buying opportunity. Market pricing reflects Chevron’s strong 2024 performance, though geopolitical risks may temper enthusiasm.

WACC Cross-Examination

Alternatively, applying WACC (8.84%) to FCFE yields a value of $114.09 per share, implying overvaluation by 16.3%. This lower estimate, less suitable for FCFE, understates equity risk. Therefore, the CAPM-based $144.38 is more appropriate, aligning with Chevron’s year-end 2024 price of $143.25.

Chevron’s Middle East Legacy

Historical Roots

Chevron’s Middle East presence spans over 70 years, beginning with Kuwait’s Burgan Field in 1938. Today, it operates in the Partitioned Zone (PZ) between Saudi Arabia and Kuwait, resuming production in 2020 with a focus on safety and technology. Additionally, since acquiring Noble Energy in 2020, Chevron holds a 40% stake in Israel’s Leviathan gas field and pursues exploration in Egypt.

Strategic Relationships

Strong ties with regional governments bolster Chevron’s resilience. For instance, its long-standing Saudi partnerships enhance operational stability. These relationships position Chevron to leverage opportunities in a dynamic region.

Impact of Middle East Stability

Operational Benefits

A stabilized Middle East, with reduced conflict, would enhance Chevron’s operations. Specifically, lower security costs and fewer disruptions in the PZ and Leviathan field would boost efficiency. Moreover, stability could attract investment, enabling gas project expansion in Egypt.

Market and Supply Advantages

Furthermore, consistent production would strengthen Chevron’s global supply chain, supporting stable cash flows. Reduced geopolitical risk might stabilize prices, particularly for natural gas, benefiting profitability. However, energy transition policies could curb oil demand, though Chevron’s gas focus mitigates this risk.

Risks and Opportunities

Key Risks

Geopolitical volatility, such as Middle East conflicts, poses operational risks, potentially disrupting FCFE. Additionally, the global energy transition may reduce oil demand, though gas investments offer a hedge. Oil price fluctuations and stricter regulations could also pressure margins.

Upside Potential

Conversely, stability could unlock new Middle East projects, boosting FCFE. Rising natural gas demand aligns with Chevron’s strategic assets, driving growth. Moreover, record 2024 cash returns enhance shareholder appeal, and the stock’s undervaluation suggests upside if stability materializes.

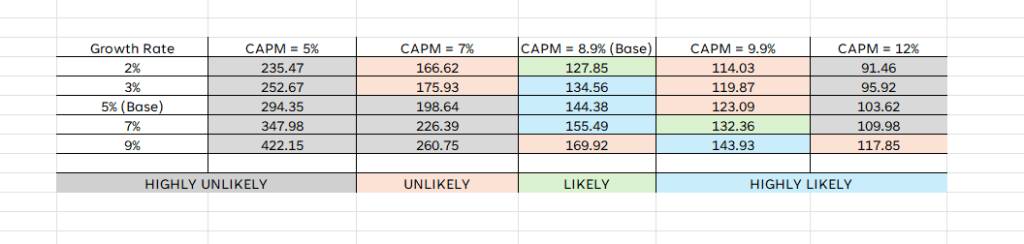

Sensitivity Analysis: Valuation Scenarios

Expanded Valuation Insights

A sensitivity analysis evaluates Chevron’s intrinsic value under varying CAPM and growth rate assumptions. The base case (CAPM = 8.9%, growth = 5%, terminal growth = 3%) yields $144.38 per share.

Key Takeaways

Higher CAPM reduces intrinsic value significantly, with a 12% rate dropping it to $103.62 at base growth. Conversely, a 5% CAPM boosts it to $294.35. Growth rate increases, like 9%, raise the value to $169.92 at base CAPM. At $136.26, the stock is undervalued in most scenarios, except at CAPM = 12%. Therefore, Middle East stability could lower CAPM or raise growth, pushing values toward $422.15, reinforcing Chevron’s investment appeal.

Chevron excels in blending financial strength with geopolitical acumen. The CAPM (9.51%) and WACC (8.84%) disparity underscores CAPM’s role in FCFE valuations, yielding an intrinsic value of $144.38, suggesting undervaluation at $136.26. Chevron’s 70-year Middle East legacy positions it to benefit from stability, enhancing efficiency and opportunities. Despite geopolitical and transition risks, its gas focus and cash returns offer upside. The sensitivity analysis confirms valuation resilience, with significant potential if stability prevails. Thus, Chevron presents a compelling opportunity for investors navigating the energy landscape.

In the near term, Chevron’s stock price is likely to remain stable around $136–$145, supported by strong 2024 cash flows and natural gas demand. However, Middle East volatility could pressure operations, while stability might boost efficiency and investor confidence. Overall, the stock’s undervaluation at $144.38 intrinsic value suggests modest upside if geopolitical risks ease.