Halliburton (HAL) stock, priced at approximately $20.25 as of April 30, 2025, appears undervalued based on a 5-year Discounted Cash Flow (DCF) analysis. This valuation uses Halliburton’s 2024 Free Cash Flow to Equity (FCFE) of $2,531 million, a cost of equity of 11.05%, and 886 million outstanding shares. Two growth scenarios—an aggressive 21.025% 5-year FCFE growth rate and a conservative 5% rate, both with a 3% terminal growth rate—highlight substantial upside potential. Additionally, recent Middle East contracts strengthen the investment case, particularly if regional stability improves.

DCF Valuation: Aggressive vs. Conservative Growth

The DCF model with a 21.025% growth rate projects FCFE from $3,063 million in 2025 to $6,571 million in 2029, yielding a terminal value of $84,078 million. Discounted to the present, this generates an equity value of $66,393 million, or $74.92 per share. However, this high valuation may overstate near-term potential due to energy sector volatility. Conversely, the 5% growth rate forecasts FCFE reaching $3,723 million by 2029, with a terminal value of $32,379 million. This results in an equity value of $31,587 million, or $33.97 per share. This conservative estimate aligns better with market dynamics and suggests a 67.8% upside from $20.25.

Why Halliburton Is Undervalued

At $20.25, Halliburton trades well below the $33.97 intrinsic value from the conservative DCF. This discount likely stems from market concerns about oil price fluctuations and geopolitical risks in regions like the Middle East. Nevertheless, Halliburton’s robust 2024 FCFE and operational efficiency indicate that the market underprices its growth prospects. If the Middle East stabilizes, particularly in Iraq, enhanced project execution could significantly boost cash flows. Moreover, stability may attract additional contracts, further strengthening Halliburton’s position.

Strategic Middle East Deals

Halliburton’s recent contracts in the Middle East, notably the Nahr Bin Omar oilfield deal in Iraq, enhance its outlook. This agreement with Basra Oil Company, nearing finalization, aims to increase production from 50,000 to 300,000 barrels per day—a 500% surge. Additionally, it includes adding 300 million cubic feet of gas. These developments promise substantial revenue growth. For instance, technological advancements, such as drilling automation with Nabors, further solidify Halliburton’s regional presence. Such projects expand its backlog, ensuring long-term cash flow stability.

Impact of Regional Stability

If the Middle East, particularly Iraq, achieves greater stability, Halliburton stands to benefit significantly. Stable conditions would accelerate project timelines and reduce operational risks. Furthermore, a secure environment could lead to new contracts, reinforcing Halliburton’s dominance in the energy services sector. Consequently, this would amplify FCFE, supporting the $33.97 valuation or higher. Meanwhile, the current $20.25 price reflects undue pessimism, offering investors a margin of safety.

Investment Opportunity

Given Halliburton’s undervaluation, with the conservative $33.97 target signaling substantial upside, the stock presents a compelling opportunity. Strategic Middle East deals, especially the Nahr Bin Omar project, provide a catalyst for growth. As a result, investors seeking exposure to the energy sector’s recovery should consider Halliburton a strong buy. Its combination of undervaluation and regional growth potential positions it well for long-term outperformance.

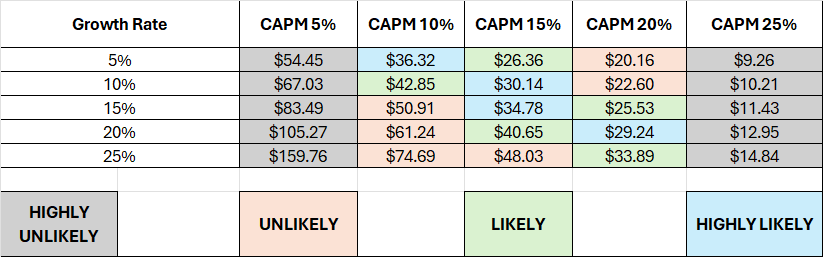

Sensitivity Analysis